-

Take your financial management to the next level with us ensuring accuracy, compliance, and strategic planning in the ever-changing realm of accounting. Explore the journey of enhanced financial control and efficiency through goerp.ai Finance & Taxation modules. Tailored to serve as a roadmap for your clients' financial endeavors, these modules guarantee consistent communication and messaging. Let's dive into the key features that make goerp.ai Finance & Taxation modules a must-have for navigating the complexities of modern accounting.

Take your financial management to the next level with us ensuring accuracy, compliance, and strategic planning in the ever-changing realm of accounting. Explore the journey of enhanced financial control and efficiency through goerp.ai Finance & Taxation modules. Tailored to serve as a roadmap for your clients' financial endeavors, these modules guarantee consistent communication and messaging. Let's dive into the key features that make goerp.ai Finance & Taxation modules a must-have for navigating the complexities of modern accounting. -

Establish a solid foundation for financial control by meticulously preparing and grouping General Ledger Masters. This feature allows for organized categorization of various accounts, facilitating easy tracking and reporting.

Strategically plan and manage financial resources with the Budget feature. Set detailed budgetary allocations for various expense and revenue accounts, enabling precise financial planning and control.

Streamline cost tracking and allocation through user-friendly Cost Centers. Assign expenses and revenues to specific cost centers, providing granular insights into the financial performance of different departments or projects.

Stay compliant and organized with an integrated Tax Master, covering GST, HSN (Harmonized System of Nomenclature), and TDS (Tax Deducted at Source). Manage tax-related accounts seamlessly and ensure accurate reporting for compliance.

Customize your financial transactions with user-driven Voucher Series Maintenance. Define unique voucher series for different types of transactions, such as Cash, Bank, Purchase, Journal, Contra, and Sale, tailoring the system to your specific accounting needs.

-

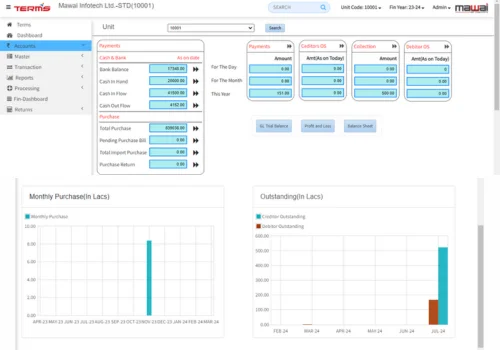

Simplify financial transactions with versatile Voucher options. Record various transactions, including Cash, Bank, Purchase, Journal, Contra, and Sale, providing a comprehensive view of different types of financial activities.

Ensure financial accuracy and transparency through systematic Monthly Closings. This process involves reconciling accounts, adjusting entries, and finalizing financial statements to provide a clear snapshot of the financial position at the end of each month.

Access detailed Books and Ledgers for comprehensive financial insights. Dive into specific accounts, track transactions, and generate detailed reports to gain a deep understanding of the financial status.

Monitor and manage outstanding payments with Aging reports for both Creditors and Debtors. These reports categorize accounts receivable and payable based on their age, helping prioritize collections and payments.

Obtain a holistic view of financial health with Profit & Loss, Balance Sheet, and Schedules. These reports summarize revenues, expenses, assets, and liabilities, providing a comprehensive overview of the company's financial performance.